Take Control of YourFinancial Future Today

Join thousands of Nigerians who save an average of ₦50,000 monthly using our AI-powered financial insights. Start building wealth with smart budgeting, automated tracking, and personalized financial advice.

"Tanta Finance helped me gain control over my spending and save 20% more each month. The dashboard is intuitive and powerful."

Active Users

Money Managed

Uptime SLA

Bank-Level Security

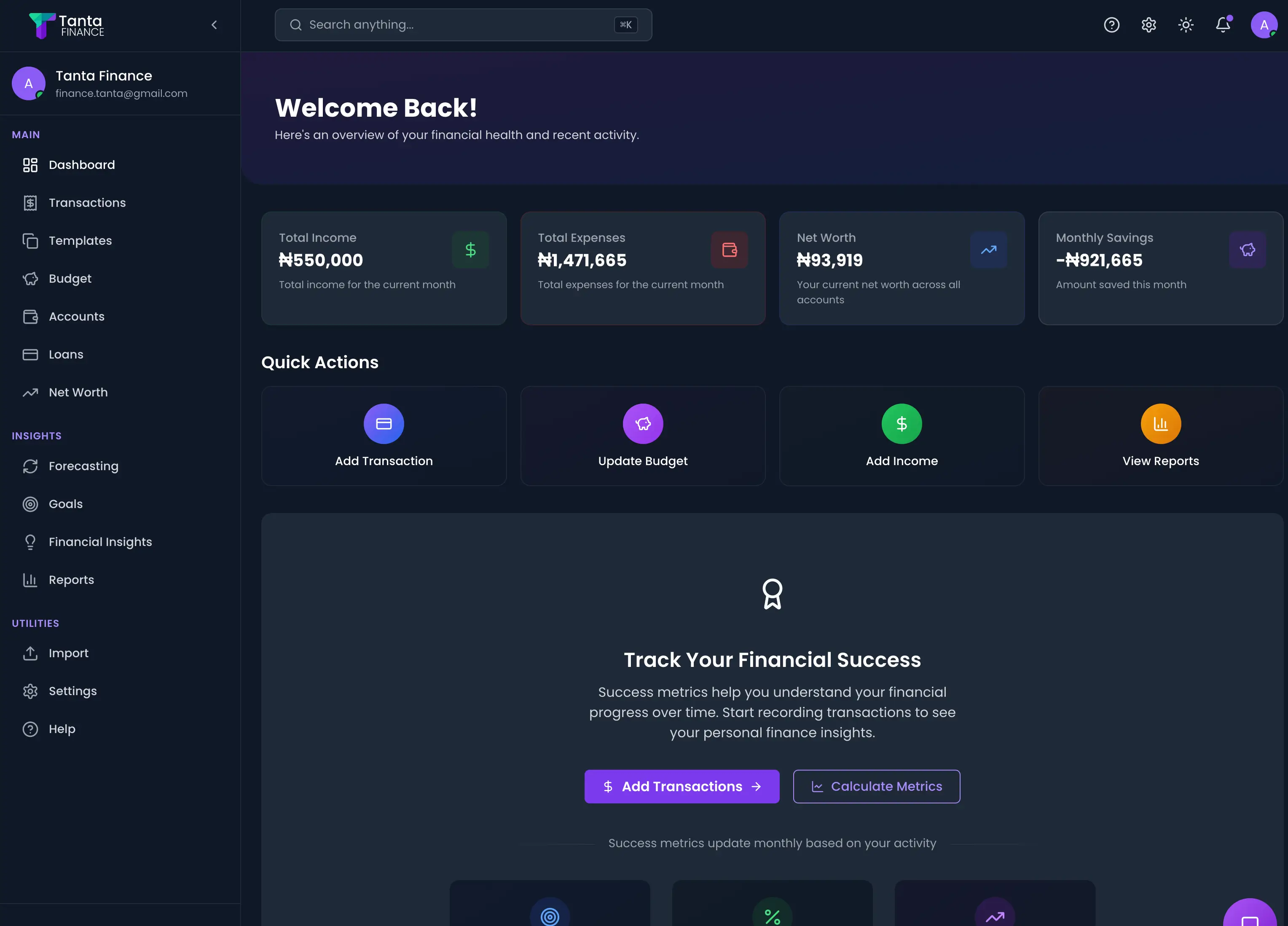

Your Complete Financial Dashboard

Everything you need to manage your personal finances in one place.

Save ₦50,000+ Monthly

Our smart expense tracking shows you exactly where your money goes, helping users save an average of ₦50,000 every month.

Never Overspend Again

Zero-based budgeting ensures every Naira has a purpose. Get instant alerts before you exceed your budget limits.

Predict Your Financial Future

See exactly when you'll achieve your goals with AI-powered cash flow forecasting that learns from your habits.

Build Wealth Faster

Track your net worth growth in real-time. Our users see an average 40% increase in net worth within the first year.

Achieve Goals 3x Faster

Set savings goals and watch your progress daily. Automated tracking helps you reach targets 3x faster than traditional methods.

Get a Personal Finance Coach

AI analyzes your spending patterns and provides actionable advice to optimize your finances, like having a CFO in your pocket.

All that's necessary

for effective

financial control.

Zero-Based Budgeting Made Simple

Give every Naira a purpose with our intuitive zero-based budgeting system. Allocate your income to expenses, savings, and investments until you reach zero, ensuring complete control over your money.

Create personalized budget categories that align with your financial goals and spending habits.

- Unlimited custom categories and subcategories

- Color-coded visual organization

- Drag-and-drop category management

- Percentage-based allocations

Experience the

cutting-edge

transaction tracking

Real-Time Transaction Management

Log every income and expense as it happens with instant updates to your financial metrics. Import from banks via CSV, add manually, or set up recurring transactions for complete financial visibility across all your devices.

Access your finances from any device, anywhere in the world

Your Complete Financial Dashboard Financial Future

Everything you need to manage your personal finances in one place.

Powerful Features for Your Financial Journey

Our comprehensive suite of tools helps you manage every aspect of your personal finances

Real-Time Expense Tracking

Log every income and expense transaction in real time with instant updates to all your financial metrics.

Zero-Based Budgeting

Allocate every Naira to a specific purpose until nothing is left unassigned, ensuring complete control of your money.

Cash Flow Analysis

Visualize the relationship between income and expenses over time with clear, actionable insights.

Net Worth Tracking

Consolidate all assets and liabilities to calculate your net worth in real time with historical trends.

Savings Goals Tracking

Define and visualize progress towards specific financial targets with automated calculations and projections.

AI-Powered Recommendations

Receive personalized financial advice based on your spending patterns, goals, and financial situation.

Simple, Transparent Pricing

Choose the perfect plan for your financial journey

Choose the plan that works best for your financial needs. Transparent pricing with no hidden fees.

Basic Plan

Perfect for individuals getting started with financial management

Cancel anytime

- Up to 3 accounts

- Up to 3 budgets

- Up to 3 financial goals

- Up to 500 transactions

- Basic dashboard access

- Basic financial reports

- Zero-based budgeting system

- Expense tracking & categorization

- Account tracking

- Financial health scoring

- Goal tracking & management

- AI financial advisor

- Two-factor authentication

- Data synchronization

- CSV import from major Nigerian banks

- Advanced analytics & insights

- Multi-user access

- AI-powered assistant

- Custom reports

- Priority customer support

- Everything in Basic Plan

- Up to 5 accounts (vs 3)

- Up to 5 budgets (vs 3)

- Up to 5 financial goals (vs 3)

- Up to 1000 transactions (vs 500)

- CSV import from major Nigerian banks

- Advanced analytics & insights

- Budget analysis & insights

- Loan management

- AI-powered assistant

- Loan optimization

- Cash flow forecasting

- Automated insights

- Budget comparison tools

- Export reports

- Investment tracking

- Automatic backups

- Multi-currency support

- Split transactions

- Business/personal expense separation

- Custom reports

- Asset allocation

- Recurring transactions

- Enhanced security features

- Priority customer support

- Multi-user access

- API access

- Dedicated account manager

Ultimate

Ideal for anyone who want advance ai personalizations and live search

Cancel anytime

- Everything in Pro Plan

- Unlimited accounts (vs 5)

- Unlimited budgets (vs 5)

- Unlimited financial goals (vs 5)

- Unlimited transaction history (vs 1000)

- Multi-user access

- Automatic transaction categorization

- Advanced reports

- What-if scenarios

- Transaction categorization

- Bulk import tools

- Automated categorization

- Custom categories

- White-label reports

- API access

- Transaction templates

- Strategy sessions

- AI recommendations

- Report builder

- Tax reporting

- Duplicate detection

- Dedicated account manager

- Investment insights

Frequently Asked Questions

Get answers to common questions about Tanta Finance and personal financial management

How does zero-based budgeting work in Tanta Finance?

- Zero-based budgeting in Tanta Finance allows you to allocate every Naira of your income to specific expenses, savings, or investments until you reach zero. This ensures complete awareness and control of your finances, minimizing wasteful spending and maximizing goal achievement.

Can I import my bank transactions automatically?

- Yes! Tanta Finance supports CSV imports from all major Nigerian banks. Simply download your statement from your bank's website and import it into Tanta Finance where our smart categorization will automatically organize your transactions.

How secure is my financial data with Tanta Finance?

- Extremely secure. We use bank-level 256-bit encryption for all data storage and transmission. Your data is never sold to third parties, and we implement robust security measures including two-factor authentication to protect your sensitive financial information.

What makes Tanta Finance different from other budgeting apps?

- Tanta Finance is specifically designed for Nigerians with local currency support, integration with Nigerian banks, and culturally relevant financial advice. Our AI-powered recommendations are tailored to the Nigerian economic environment and personal financial landscape.

How does the AI provide personalized financial recommendations?

- Our AI analyzes your spending patterns, income trends, and financial goals to provide recommendations specific to your situation. It identifies areas where you can reduce spending, suggests optimal saving strategies, and helps you make data-driven financial decisions.

What are Tanta Finance's subscription options?

- Tanta Finance offers three subscription plans tailored for Nigerians: Basic (₦2,000/month), Pro (₦6,700/month), and Ultimate (₦15,000/month). Each plan includes a 14-day free trial, and you can save with annual billing. The Basic plan covers essential financial management with up to 3 accounts, while Pro and Ultimate add advanced features for more comprehensive financial control.

What Our Users Say

Join thousands of users who have transformed their financial lives with Tanta Finance.

“I saved ₦1.2 million in 8 months using Tanta Finance. The AI insights showed me I was spending ₦80,000 monthly on things I didn't even need!”

Chioma Adeyemi

Tech Entrepreneur, Lagos

“As a doctor with irregular income, budgeting was impossible. Tanta's smart forecasting helped me stabilize my finances and buy my first car debt-free.”

Dr. Emeka Okafor

Medical Consultant, Abuja

“The multi-currency support is perfect for my import business. I track expenses in Naira, Dollars, and Pounds seamlessly. Saved me ₦3M last year alone!”

Funke Balogun

Import/Export Business Owner